child tax credit payments continue in 2022

The advance child tax credit payments were based on 2019 or 2020 tax returns on file. The advance child tax credit payments were based on 2019 or 2020 tax returns on file.

Child Tax Credit Parents Struggle And Poverty Expected To Rise As Enhanced Benefits End Cnn Politics

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

. That means the child tax credit returns to a 2000 lump sum for individuals making up to 200000 and couples filing jointly who make up to 400000 with 1400. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. The maximum child tax credit amount will decrease in 2022.

MILLIONS of Americans have already filed their 2021 federal income tax return by the April 18 deadline. Those returns would have information like income filing status and how many children are. 15 hours agoThe Internal Revenue Service is sending letters to millions who did not claim stimulus payments earned income tax credits child tax credits or other benefits.

Households making less than 12500 and married couples making under 25000 can turn in a simplified tax return via a website the federal government built for the child tax. The advance child tax credit payments were based on 2019 or 2020 tax returns on file. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. That means the child tax credit returns to a 2000 lump sum for individuals making up to 200000 and couples filing jointly who make up to 400000 with 1400. Those returns would have information like income filing status and how many children are.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

Those returns would have information like income filing status and how many children are. The last of those monthly payments went. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

Parents of children age 17 and under got a 1000 bump in their child tax credit for 2021 half of which was paid in monthly installments. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Those returns would have information like income filing status and how many children are.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Within those returns are families who qualified for child tax credits CTC. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

The advance child tax credit payments were based on 2019 or 2020 tax returns on file.

1 8m New Yorkers To Receive Tax Credit Relief

Child Tax Credit 2022 Direct Payments Up To 750 Going Out This Month See Exact Date The Us Sun

The Child Tax Credit What S Changing In 2022 Northwestern Mutual

/cdn.vox-cdn.com/uploads/chorus_asset/file/23979633/GettyImages_1369365621.jpg)

Will Child Tax Credit Payments Continue In 2023 The Fight Is Not Over Vox

Child Tax Credit 2022 Forced To Pay Irs

2 000 Child Tax Credit 2022 Who Is Eligible For Payment As Usa

Build Back Better S Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

September Child Tax Credit Payments Are Here What Happens If Irs Misses You Fingerlakes1 Com

I M Not Giving Up Sen Michael Bennet S Drive To Make The Expanded Child Tax Credit Permanent Colorado Public Radio

The Covid 19 Pandemic Underscored The Child Tax Credit S Power To Alleviate Family Poverty Urban Institute

Federal Stimulus Update Will Child Tax Credit Monthly Payments Restart

Child Tax Credit Will Monthly Payments Continue In 2022 Abc10 Com

Child Tax Credit 2022 Extension Update Is It In The Biden Plan King5 Com

The 8 000 Child Tax Credit That Many Parents May Not Know About Cbs News

Child Tax Credit Will Monthly Payments Continue Next Year Al Com

Monthly Child Tax Credit Payments Have Ended And Their Future Is Unclear

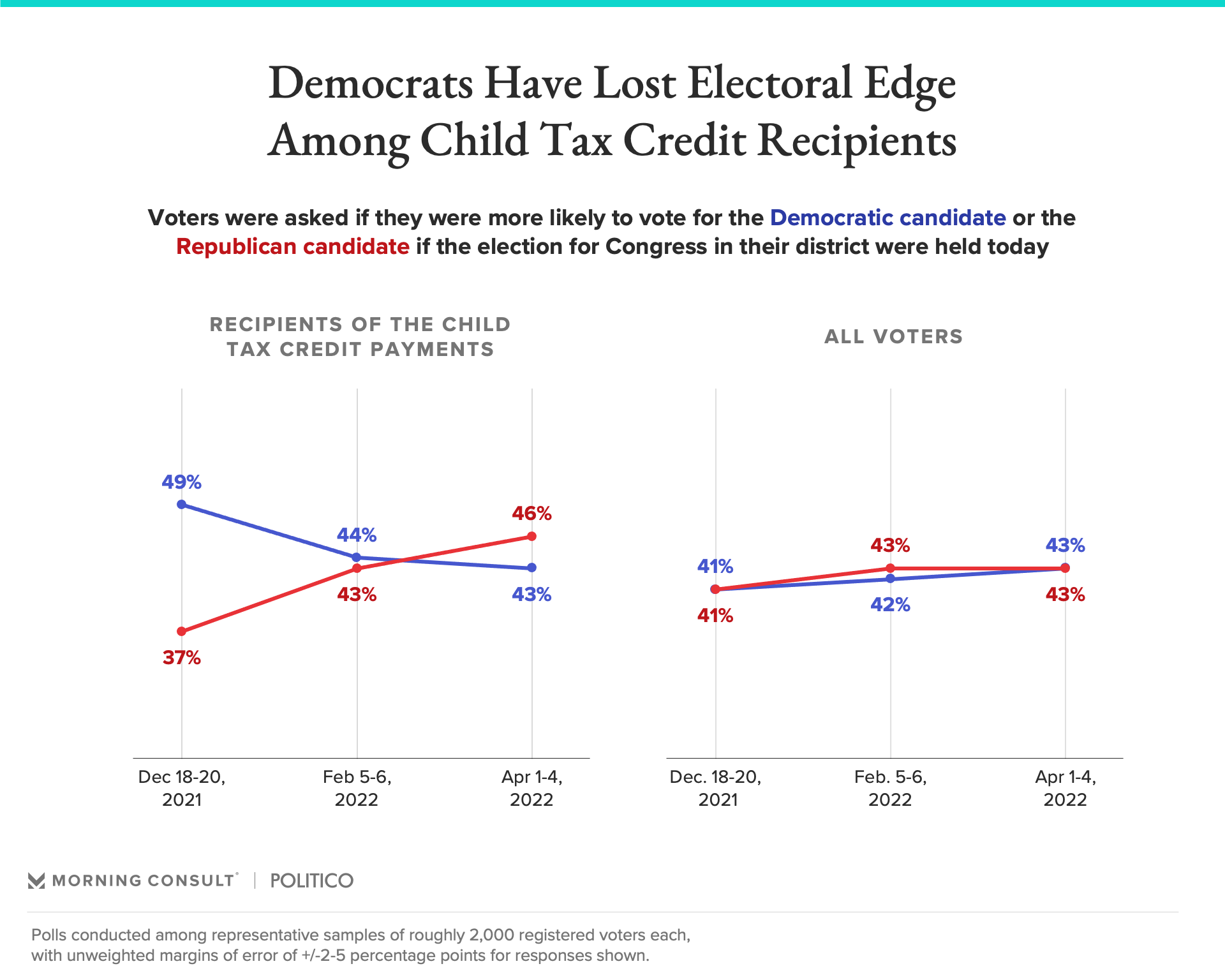

Republicans Favored To Win Senate Among Child Tax Credit Recipients

Families Won T See Child Tax Credit Payments For First Time In Six Months